As a Chabad shaliach, you have specific financial obligations and responsibilities that differ from the average taxpayer. Whether you’re managing the complexities of foreign earned income, navigating the rules around housing allowances, or dealing with the intricacies of dual citizenship, you need a tax professional who truly understands your situation.

My tax service is tailored to meet these needs, offering personalized support to ensure you’re not only compliant but also maximizing the benefits available to you. Whether you’re stationed in a remote area or in a bustling city, my expertise covers the spectrum of tax issues you might face, from filing requirements in the U.S. to understanding the tax implications of living abroad.

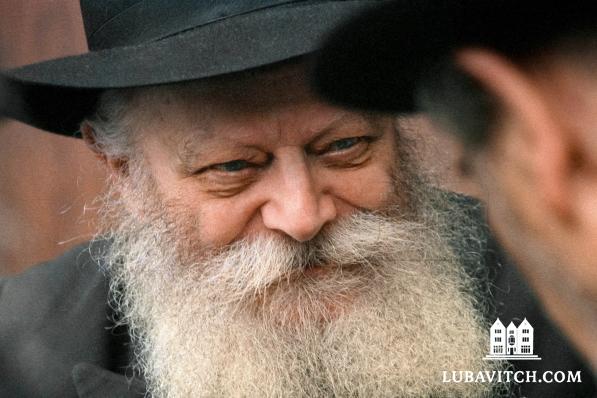

Additionally, I also cater to shluchim living in America, who have their own set of challenges, such as managing deductions for home-based activities or religious service expenses. My goal is to make the tax process as smooth and stress-free as possible, so you can focus on the Rebbe’s mission without worrying about financial complexities.

I also specialize in setting up llcs, 990 tax exempt organizations and other businesses entities for shluchim who need it.

Contact me today. Looking forward to working with you!